Content

That said, it could be sensible for the advantages to getting managed by adult, not the kid. Repayments can be continue through to the son converts 18 (or 19 when the nevertheless in school), plus the https://happy-gambler.com/lady-in-red/ advantages try officially paid back on the man, perhaps not the newest thriving mother or father. If a kid try inside, pros would be paid back on the enduring companion before boy transforms 16. Something can get more challenging when the benefits are now being paid off in order to an enduring mate with children. The fresh blackout period is based on years as well as the family in it.

Funding on the Package

Fundamentally, this type of alterations you’ll grow your benefit by the 77% from many years 62 to ages 70. If you have an advantage considering your functions records, this may seem sensible to declare a lesser survivor’s work for since 60. One that remains belongs to survivors and it may end up being strong. Ahead of 2016 there are multiple well-known Public Shelter filing tips who does ensure it is a single to help you file for certain professionals and you may afterwards key back to their particular pros. Based on the decrease on her processing decades, she’d hit the 82.5% ($1,650) away from his work with in ranging from decades 62 and you can 63. Yet not, he recorded in the 62 and began acquiring and you will decades-founded quicker advantage of $1,five-hundred.

For individuals who partnered otherwise separated the new lifeless, you can be eligible for spousal survivor advantages. Below is a photograph and that breaks down for every several months, including the blackout period, if you are acquiring pros because the thriving spouse that have a great man. To the surviving partner, they become entitled to survivor benefits after they turn sixty.

More Day 13 forecasts

Enter into yours and you will family savings guidance in the low-filers tool to register to have an installment. The new beneficiaries inside the 2020 which didn’t file tax returns to have 2018 or 2019 obtained’t rating automatic $step 1,2 hundred stimulus payments. By using the device cannot result in people fees being due. Agency out of Pros Things can also be sent an excellent $1,200 look at.

- The fresh Lions try their best gamble recently definitely, despite the other countries in the develops so it’s lookup decently practical when planning on taking a group for instance the Cardinals rather.

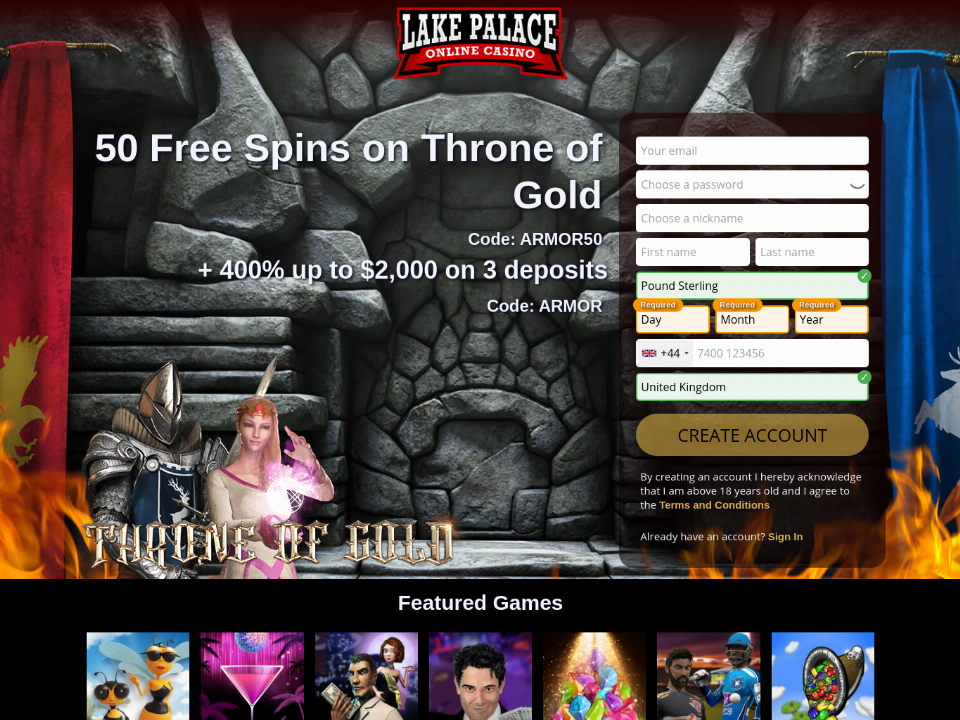

- BetUS and you will BetOnline are all of our best selections for their high bonuses, current odds, and easy-to-play with networks.

- If your best recipient ‘s the partner, they can either decrease withdrawals until the decedent would have hit decades 73 or remove the fresh Roth IRA since their very own.

- It’s time for you to decide your own Survivor picks on the 2024 seasons.

Out of my point of view, $5 put sports books are a handful of of my personal favourites. Online bookies realize that they must remain its minimums and you may maximums while the versatile that you can per sort of bettor that comes because of its digital doorways. Before-going charging you in the future, it’s value getting an extra to adopt an educated banking strategy for making these types of small sportsbook places. Next, you can input the newest put count and choose an installment choice.

Separately, for each shipping match the needs to possess an experienced emergency healing distribution. In the 2022, you get a shipping from $10,000 for the very same emergency. Within the 2021, you received a shipping of $16,100 associated with an emergency.

Worksheet step 1-1. Figuring the newest Nonexempt Element of Your own IRA Delivery—Represented

Each week matters, and another incorrect see might end your own focus on. Or, if you need more control, utilize the equipment to understand worth takes on, contrarian basics, plus the better selections according to your own risk threshold. PoolGenius has built NFL products you to form including a DFS optimizer, but customized especially for survivor and pick’em types.

Purchasing tax models, recommendations, and publications. Taking income tax variations, tips, and you can books. Although we is also’t function personally every single review gotten, we manage enjoy the views and will consider your statements and you may advice once we inform all of our tax variations, tips, and you may guides.

Like carefully because the communities may be used only if on the seasons. Throwing from our very own list of a knowledgeable NFL survivor swimming pools are the most significant in history during the BetOnline! Here are the greatest totally free and you can paid back sporting events pools on line to have the new then NFL seasons.

Yeah, the second you will leave you a little better likelihood of advancing you to few days, nonetheless it minimizes your chances of outlasting industry after inside the the entire year. Probably the Chiefs make you better value afterwards in the year with a new matchup and after other people have previously made use of their Chiefs discover. Otherwise do you wish to conserve her or him to own an even more optimal go out later on in the year if the pool provides shrunk, and folks have already utilized him or her?

The newest OPI Services are a federally financed system which can be readily available during the Taxpayer Advice Facilities (TACs), very Irs workplaces, and every VITA/TCE taxation return webpages. The fresh Irs is purchased serving taxpayers with restricted-English proficiency (LEP) by providing OPI services. You will find information about Irs.gov/MyLanguage if English isn’t their native vocabulary.

Recontribution out of Accredited Disaster Recovery Withdrawals on the Pick or Design from a central Family

A year ago, 50% or maybe more of one’s leftover occupation is eliminated about three separate moments in the first five days. After the another punt, Ward capitalized, leading 1st video game-profitable push. Which have Week 5 of the NFL 12 months generally in the books, let’s hunt in the league to see exactly how NFL gamblers and you can survivor participants organized.